Economic Update: What Moved Markets in 2019

I trust everyone had a wonderful holiday season. Whether you reached your personal goals last year, faced challenges, or are looking for a 2020 reboot, a new year and a new decade bring challenges and opportunities.

This month, I want to review the year that just ended and take a peek at the upcoming year.

Before we jump into a review of 2019, let’s touch on the events that led up to last year’s impressive rebound.

As 2018 came to a close, stocks were in the midst of a steep sell-off, which shaved nearly 20% off the S&P 500 index over a three-month period.

At the time, the Fed was on rate-hike autopilot, i.e., gradually increasing the fed funds rate in quarter-point increments. In addition, the Fed was allowing bonds purchased during its bond buys (popularly called QE or quantitative easing) earlier in the decade to run off its balance sheet.

The rate hikes, which began in late 2015, did little to deter bullish enthusiasm. That is, until October 2018 when investors began to fret that the Fed might be on the verge of a policy mistake that could tip the U.S. economy into a recession.

Mix in rising trade tensions with China and a steep and unsettling correction ensued. It rivaled the sell-off in 2011, which was tied to recession fears and a widening eurozone debt crisis.

A loss of just seven more points on the S&P 500 Index would have officially ended the bull market, which began in 2009.

Let’s take a step back for a moment.

Sometimes, investors overreact. It’s happened before, and it will happen again. There is an emotional component that can dictate actions among short-term traders. There are also computer-based trading programs that can influence sentiment and exacerbate market moves.

Sometimes, excess euphoria breeds too much enthusiasm and stocks become overvalued, at least temporarily. We saw that in early 2018.

As 2018 came to close, the opposite occurred. Pessimism ruled the Street, and stocks were undervalued. Economic growth was poised to moderate but not stall. Profit growth slowed to a crawl last year, but an earnings recession did not ensue.

2019’s comeback

As we look back at 2019, trade headlines and Fed policy had the biggest influences on sentiment.

Throughout the year, market action marched to the beat of trade. Positive trade headlines generated enthusiasm and tensions created pullbacks.

Zoom in on May and August, and rising tensions forced the bulls to the sidelines. Still, the broad-based S&P 500 Index lost less than 7% during each of the pullbacks (St. Louis Federal Reserve S&P 500 data). Such declines are modest by historical standards.

In my view, a more flexible Fed and continued economic growth cushioned the downside.

Speaking of the Fed, let’s drill down on the shift in policy at the central bank.

The Fed quickly altered its stance in January, going on hold as it abandoned its desire to keep bumping up the fed funds rate.

The Fed completed its pivot in the middle of the year. Instead of two projected rate hikes in 2019 (per FOMC projections made in December 2018), the Fed eased and cut rates three times.

We began the year with a fed funds rate of 2.25%-2.50% and ended the year with a rate of 1.50%-1.75%. Undoubtably, it was a dramatic about-face that was dictated by a changing economic environment.

Additionally, the Fed stopped shrinking its balance sheet. By year end, the Fed was back in the open market purchasing shorter term bonds and T-bills, at least temporarily. While it refuses to use the term “QE,” in effect, it’s employing a similar policy to what it used earlier in the last decade.

In December, Fed Chief Jerome Powell hinted that he is in no hurry to take back any of the rate cuts in 2020.

Moreover, recession fears earlier in the year have subsided, and the U.S. and China will sign a limited, phase-one trade deal this month. It’s not the all-encompassing agreement that investors had hoped would be inked earlier last year, but it reduces near-term trade tensions.

New negotiations, which could eventually lead to a more comprehensive phase-two agreement, will resume, though the outlook for additional progress is murky.

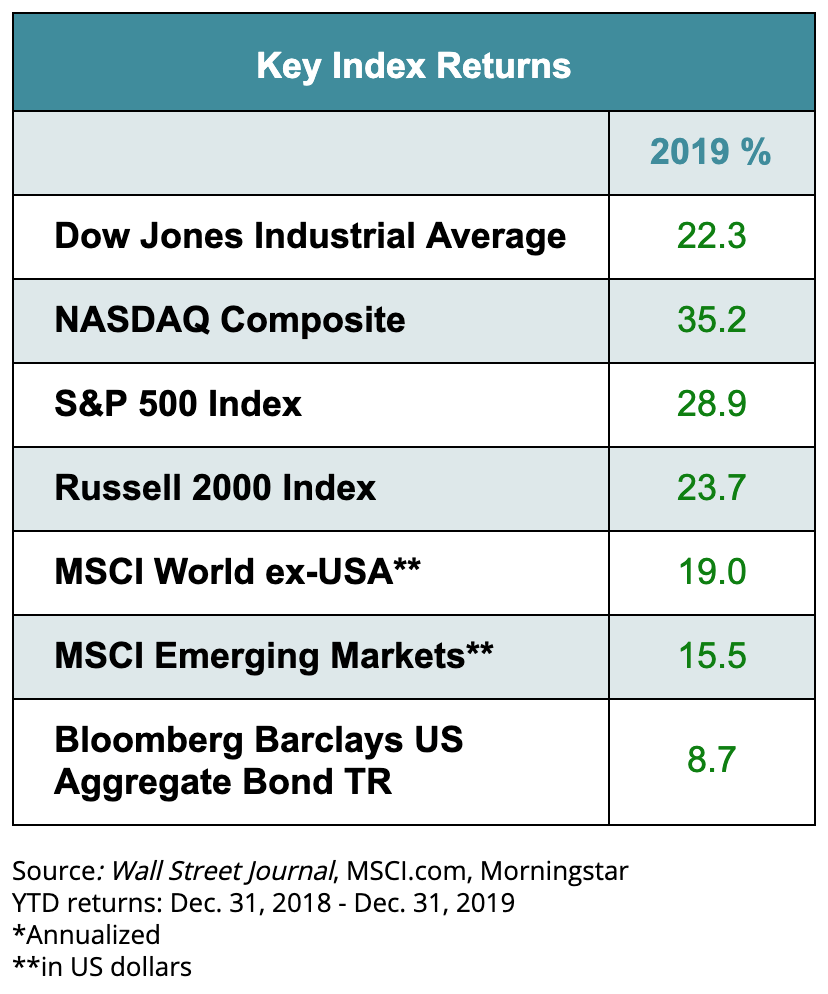

Bottom line—stocks finished the year in an impressive fashion.

Longevity—one for the record books

The current economic expansion began in July 2009, according to the National Bureau of Economic Research (NBER), the official arbiter of recessions and expansions.

Ten years later, the economic expansion entered the record books, surpassing the long-running expansion of the 1990s. Following the financial crisis and Great Recession, few thought the expansion would last this long. Few thought we’d ever see the jobless rate fall below 4% again. Once again, the U.S. economy has been surprisingly resilient.

That said, should we really be surprised? The U.S. economy is incredibly dynamic. The attributes that make America the greatest nation in the world continue to pay economic dividends. Once again, the economy bounced back when many thought it was down for the count.

That leads us to the next question, and one of a shorter term nature. Might a recession be lurking in 2020?

A Conference Board survey of CEOs and top-level executives noted, “For U.S. CEOs, a recession rose from being their third biggest concern in 2019 to their top one in 2020.”

Global growth slowed last year, and activity in the U.S. manufacturing sector has been soft. A recession is inevitable, but is 2020 the year?

Economists haven’t done a very good job of forecasting recessions, but conditions that generally lead to a recession aren’t in place today. These include:

- Rising interest rates and rising inflation.

- A credit squeeze that cuts off lending to businesses and consumers.

- Asset bubbles. Stocks aren’t cheap, which make them vulnerable to unexpected events, but valuations (P/E ratios) are nowhere near levels seen in 2000.

- Oil supply shock.

In addition, the long-running expansion has been subpar. That means we haven’t seen the excesses and imbalances that breed too much euphoria and excess spending.

While manufacturing has been soft and the Conference Board’s Leading Index isn’t suggesting a near-term acceleration in growth, the broader-based service sector is expanding and consumer spending has been strong. Further, stock market action isn’t foreshadowing a near-term recession.

Playing the averages

If I flip a coin, there is a 50-50 chance I’ll get heads. If I walk into a casino and put my money on the table, the odds are stacked against me.

If I simply purchase a broad-based, diversified stock market index at the beginning of the year, historically, the odds have been in my favor.

Before I go on, we rarely recommend all-stock portfolios. There’s too much risk of shorter-term volatility. For others, income may be the primary consideration, not capital appreciation. Put another way, our recommendations are customized to your goals and preferences.

However, if we look back at the data over the last 60 years, stocks have been an excellent vehicle for individual investors to create wealth.

Using data provided by the New York University School of Business (2019 returns taken from S&P Dow Jones Indexes), the S&P 500 Index has risen 47 years and has fallen 13 years (total return, dividends reinvested 1960-2019).

That’s an impressive performance that covers rising and falling inflation, rising and falling interest rates, wars and peacetime, and several expansions and recessions.

But returns have varied by a wide margin.

When the S&P 500 Index finished the year lower, the average annual decline has been 12.7%. The range of the annual decline: -3.1% to -36.6%. Yes, there are times when the bulls are beaten up.

When the S&P 500 Index finished higher, the average annual increase has been an impressive 18.0%. The range of the annual increase: +0.3% to +37.2%.

Stocks have a long-term upward bias. It’s a theme I’ve repeated often, and the data bear this out.

I view a well-diversified portfolio as the economic equivalent of purchasing a stake in the U.S. economy. We don’t know if the economy will be larger next year, but over a long period, the U.S. economy has expanded. We see it reflected in long-term stock market performance.

Investor’s corner

There will be times when the outlook sours, but as we’ve seen time and time again, the U.S. economy has recovered and gone on to new highs.

We know that stocks can be unpredictable over a shorter period. While they are sometimes unpleasant, sell-offs are normal. But we take precautions to minimize volatility and, more importantly, keep you on track toward your financial goals.

As we move into a new decade, I’m reminded of a remark by the legendary investor Warren Buffett.

“For 240 years it’s been a terrible mistake to bet against America, and now is no time to start. America’s golden goose of commerce and innovation will continue to lay more and larger eggs.”

I hope you’ve found this review to be helpful and educational.

Let me emphasize again that it is my job to assist you. If you have any questions or would like to discuss any matters, please feel free to give me a call.

As 2020 gets underway, I want to wish you and your loved ones a happy and prosperous new year!