Treacherous Times and Hope for the Future

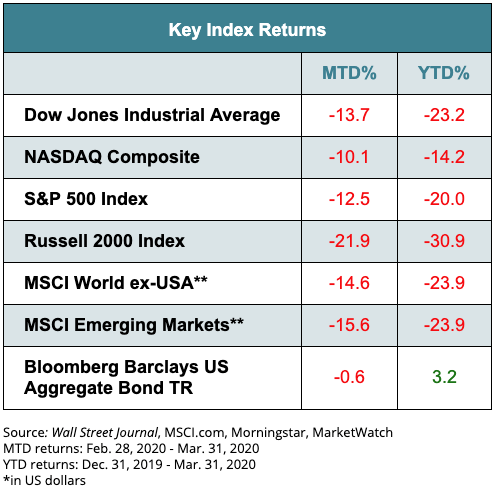

It has been a difficult month for investors. Since the February 19th peak, the S&P 500 Index has shed 34% to its most recent low (St. Louis Federal Reserve). That’s roughly in line with the average bear market pullback (LPL Research), with bear markets being defined by at least a 20% sell-off.

However, the rapid decline in the major stock market indexes has been unsettling. The 34% drop occurred in just over one month. It’s unprecedented.

But what we are seeing in the economy is without precedent, too. There is an enormous amount of uncertainty. Many industries that require person-to-person interactions are being shut down. And many of the service-related companies that remain open have seen a significant drop in traffic.

Since there is no modern precedent on which to model economic forecasts, the second-quarter projections for GDP have been incredibly wide. If we connect the dots, the economic uncertainty has translated into earnings uncertainty which in turn has translated into incredibly volatile markets.

A government-induced economic coma

In order to slow the spread of the pandemic, the government has encouraged social distancing, and several states have ordered lockdowns or strict shelter-in-place mandates. You may go outside to exercise or head to the grocery store, but there is a ban on social gatherings, which would spread the virus.

While social distancing will slow the spread of COVID-19, the economic impact has been unparalleled. In a way, the government is putting key sectors of the economy in a coma, as it hopes to stem the spread of the virus. When health and safety dictate, the goal is to bring the ‘patient’ out of the coma.

But policymakers aren’t expecting the economy to bounce back on its own. If shutdowns are encouraged or enforced, policy is being put into place to revive the patient when the time comes.

The government response to soften the expected economic blow has been extraordinary and goes well beyond what we saw during the 2008 financial crisis.

The Federal Reserve has not only dropped the fed funds rate to zero, but it has implemented several programs designed to support Treasury bonds, investment-grade corporate bonds, commercial paper (short-term IOUs issued by the largest corporations), money market funds, mortgage-backed securities and municipals.

Further, a new program designed to support small- and medium-sized businesses will be forthcoming.

During the financial crisis, the Fed’s focus was on Wall Street and critical credit markets. Today, the scope of support extends well beyond Wall Street and into Main Street.

Meanwhile, Congress has passed and the President has signed a $2 trillion stimulus bill.

In addition to mitigating some of the damage from surging layoffs, the Federal Reserve and the Federal government are trying to put a foundation in place that will support a robust economic recovery.

Will it work? Much depends on the duration and severity of the recession and the path of the virus.

Road to recovery

I see four steps that are important.

- A massive response by the Federal government and the Federal Reserve. I think we can check that box. While continued volatility is likely, a modest rebound from March’s low was fueled by the Fed and the $2 trillion stimulus plan.

Other pieces of the recovery puzzle include:

- A peak in new U.S. cases and subsequent decline.

- An effective treatment and vaccine.

- Clarity on the economic data. What will be the steepness and duration of the recession?

No one rings a bell that sounds the all-clear signal. Collectively, markets attempt to price in future events. Given the wide range of outcomes, volatility has been the rule.

But stocks will likely bottom before the economy rebounds.

Thoughts

I spend an enormous amount of time discussing the importance of your financial plan. It is our roadmap in good times and bad.

It is based on a simple premise: stocks rise more than they fall, and stocks rise more than they fall because historically, the U.S. economy has expanded over time.

I understand that what is happening is unprecedented. We are in the midst of an economic and health care crisis. Both breed fear and uncertainty.

But I am confident this pandemic eventually will pass, and I am confident that the underlying fundamentals of the U.S. economy remain strong. Resilience and ingenuity are part of the DNA that make up America. We will persevere and we will recover.

If you have questions, concerns, fears, and doubt–well, I get that. I really do. And please remember, my door is open. I’m always available.

Social distance yourself from COVID-19 scams

Whenever there is a natural disaster, there are always people who prey on those who want to help. Today, the disaster is a pandemic. Many are fearful, many are scared. It makes us especially vulnerable.

The FTC has warned Americans to beware of the potential scams that are proliferating. Here are some precautions to take that will keep you safer:

- Hang up on robocalls, and don’t press any numbers. Scammers are using illegal robocalls to pitch fraudulent COVID-19 treatments and work-at-home schemes. Press a number to be removed from a list and you’ll likely get more calls.

- Ignore online offers for vaccinations and unproven home test kits.

- Ignore texts and emails about cash from the government. Stimulus checks will be forthcoming, but, per the FTC, anyone who tells you they can get you the money now is a scammer.

- Please be leery of emails that claim to be from Centers for Disease Control and Prevention (CDC) or experts that claim they have information about the virus. For the most up-to-date information about coronavirus, visit the websites of the CDC or the World Health Organization (WHO).

- On the same note, malware and phishing scams are on the uptick. Legitimate companies will never ask you to verify passwords or usernames via an email. Fraudsters will.

- Do you see misspelled words or grammatical mistakes? That’s a sure sign that the official-looking email originated from a suspicious source.

Here’s a warning from the Securities and Exchange Commission (SEC) that was updated on March 30:

Fraudsters often use the latest news developments to lure investors into scams. We have become aware of a number of Internet promotions claiming that the products or services of publicly traded companies can prevent, detect, or cure coronavirus, and that the stock of these companies will dramatically increase in value as a result.

Please be aware of the substantial potential for fraud at this time.

Please be careful. We are living in uncertain times. While I am confident this will pass, uncertainty breeds fear, and there are criminals all over the world ready to cash in on your fear.

How to spend your free money

Four in 10 adults say they would struggle to come up with $400 in an emergency, according to the Federal Reserve’s annual check-in on Americans’ financial health. Well, most are about to get at least $1,200 after passage of the stimulus bill designed to ease the economic downturn that is occurring. Throw in $500 per child and a family of four nets $3,400.

Are you eligible? For singles, $1,200 is phased out between $75,000 and $99,000 in adjusted gross income. For married folks, the range is $150,000 to $198,000.

So, how will you spend your windfall? I’d like to say that you should go and spend it. It’s designed to help the economy. And you may decide to make purchases from a small business in your neighborhood. Undoubtedly, they need the help.

But let’s consider the underlying financial principles that drive your balance sheet.

Do you need a rainy-day fund? Do you have three to six months of emergency cash, just in case? If not, consider putting your check into savings. If you don’t expect to be furloughed, an emergency fund is one way to go.

If you have at least six months in savings, look at debts, especially high-rate credit cards. That will provide you with an immediate return.

But I would be cautious about putting your cash into student loans. Borrowers are receiving relief from the government. So you may want to hold off paying down student debt, at least for now.

Can you give it away? Are you in a strong financial position?

You may gift the check to your parents, your children, or those who are in a difficult place. When businesses reopen, consider generously tipping your server who has been out of work. Even something as simple as a lavish tip to the delivery person can generate tremendous goodwill.

When we take our eyes off ourselves, the blessings we give away rebound in our direction.